Silver, Gold, Paper & Stablecoins

For much of US currency history, you could pick what dollar currency you wanted to use based on its backing.

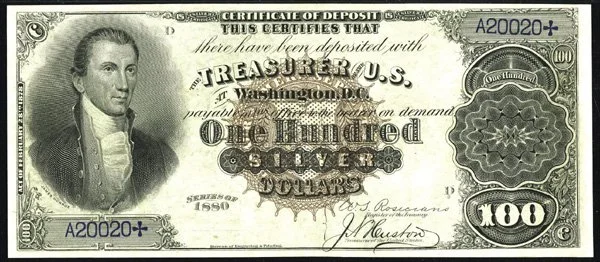

In the 1880s, for example, the US had four major types of currency: Silver Certificates, Gold Certificates, United States Notes, and National Bank Notes. Silver Certificates were certificates of deposit of silver. The note represented (was a token) that someone had deposited the requisite silver in the US Treasury, and it was kept in a vault until the note was redeemed in silver. The same was the case for a Gold Certificate, except here gold was deposited and held. The United States Note was backed by a fractional gold reserve held by the Treasury, roughly 50%, and the strength of the US economy. National Bank Notes were backed 100% by US Treasury bonds.

So, we have four different tokens with different backings, which could be used interchangeably in the economy as their dollar-denominated values were considered equal. However, certain types of money had different uses because of their backing.

Gold Certificates tended to be used for interbank settlements or official payments. Silver Certificates tended to be used for remittances and everyday transactions. United States Notes were largely used for low-value transactions. National Bank Notes were the same but tended to be regional currencies.

Does this remind anyone of stablecoins with their different backings? If in the US, during the 1880s, different currency tokens operated side by side, why couldn't this happen now? Why can't different stablecoin tokens, with different backings, operate side by side in the modern economy? Let the consumer pick the kind of currency he or she wants to use for a particular purpose.

Perhaps, once again, the past is prologue.

Pictured is an early Silver Certificate.